Loading

Get Hi Doe 403(b) 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DOE 403(b) online

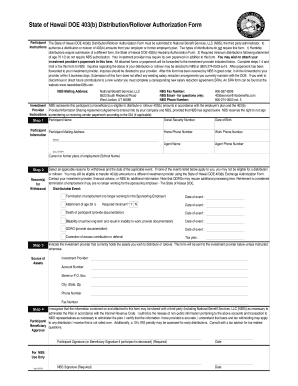

This guide provides a step-by-step approach to completing the HI DOE 403(b) Distribution/Rollover Authorization Form online. It is essential for users to follow these instructions carefully to ensure the accurate submission of their distribution or rollover requests.

Follow the steps to complete your HI DOE 403(b) form with ease.

- Click the ‘Get Form’ button to obtain the form and open it in your document editor.

- Provide your participant information: Complete the fields for your name, mailing address, home phone number, work phone number, and the current or former place of employment.

- Select the applicable reasons for withdrawal from the provided list. Indicate the date of the event for each reason selected. Ensure you have the necessary documentation if required, such as for death or disability.

- Identify the investment provider that currently holds your assets. Fill in the provider's name, account number, and contact details, including the street address, city, state, and zip code.

- Acknowledge the authorization and certification. Indicate your consent to share the information as needed with NBS. Sign and date the form where required.

- After completing all sections, it is crucial to review the form for accuracy before submission. Once satisfied with the information provided, save changes, download, print, or share the form as necessary.

Begin completing your HI DOE 403(b) Distribution/Rollover Authorization Form online today to ensure your request is processed efficiently.

While the HI DOE 403(b) plan offers many benefits, it also has some disadvantages. For instance, early withdrawals may incur penalties and tax liabilities, potentially affecting your savings growth. Understanding these drawbacks can help you make informed decisions about your investment strategy and consider alternatives if necessary.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.