Loading

Get Do Not Return This Form Unless Your Child Needs Medication ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DO NOT RETURN THIS FORM UNLESS YOUR CHILD NEEDS MEDICATION ... online

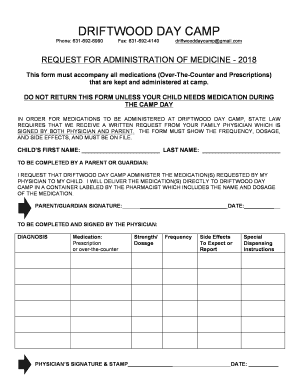

This guide provides you with essential steps to successfully complete the DO NOT RETURN THIS FORM UNLESS YOUR CHILD NEEDS MEDICATION ... form. Ensuring proper medication administration for your child at Driftwood Day Camp is crucial, and this guide will help you navigate the process with ease.

Follow the steps to successfully fill out the medication request form.

- Click the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin filling in your child's information. Enter the child's first name and last name in the designated spaces.

- Locate the section to be completed by a parent or guardian. Indicate your request for Driftwood Day Camp to administer the specified medications, as prescribed by your physician.

- You must acknowledge that you will deliver the medications directly to the camp in a pharmacist-labeled container, which includes the medication's name and dosage. Confirm this understanding in writing.

- Sign and date the form where indicated for the parent/guardian's signature.

- Next, proceed to the section that must be completed by the physician. Your physician will need to provide their diagnosis and indicate whether the medication is prescription or over-the-counter.

- Instruct the physician to fill in the medication strength/dosage and the frequency of administration.

- Ensure the physician includes any potential side effects and any special dispensing instructions.

- Finally, the physician must sign and date the form, providing their official stamp.

- Once all fields are complete and verified, you can save any changes made to the form, download a copy for your records, print it for submission, or share it as required.

Complete your documents online today to ensure smooth medication administration for your child at camp.

Purpose of Form For children under age 18 and certain older children described below in Who Must File , unearned income over $2,500 is taxed at the parent's rate if the parent's rate is higher than the child's. If the child's unearned income is more than $2,500, use Form 8615 to figure the child's tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.