Loading

Get Ke Vat 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KE VAT 3 online

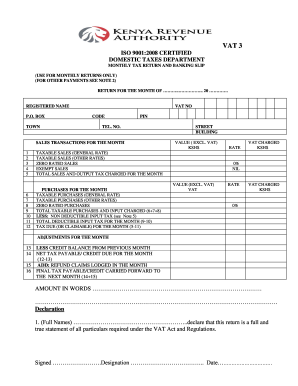

Filling out the KE VAT 3 form correctly is essential for making accurate monthly tax returns. This guide provides clear and supportive instructions designed to help users complete the form online, ensuring compliance with tax regulations.

Follow the steps to fill out the KE VAT 3 form online

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Enter your registered name, P.O. box number, town, VAT number, PIN, and telephone number in the designated fields.

- Fill out the sales transactions for the month by entering values in the respective fields labeled 1 through 12. Provide the values excluding VAT and ensure you categorize them appropriately.

- In the section for taxable sales, indicate the amounts for taxable sales at the general rate, other rates, zero-rated sales, and exempt sales. Calculate and enter the total sales and output tax charged for the month.

- Next, list your purchases for the month. Fill in the taxable purchases at the general rate, other rates, and zero-rated purchases in the appropriate fields.

- Calculate the total taxable purchases and input tax charged by summing the values entered and deducting any non-deductible input tax.

- Determine your total deductible input tax for the month, and then calculate the tax due or claimable for the month by following the instructions specified.

- If applicable, include adjustments for the month, including any carried over credit balance from the previous month.

- Calculate the net tax payable or credit due for the month and add any refund claims lodged during the month.

- Finally, fill out the declaration section with your full name, designation, and date. Ensure the return is signed by the appropriate authority such as a director or principal officer.

- Review all the filled sections carefully for accuracy and completeness.

- Save changes, download the completed form, and print a copy for your records.

Complete your KE VAT 3 form online today to ensure timely and accurate tax submissions.

Related links form

How do I file my VAT return? VAT Returns can be filed online via your ROS account. If you have not already set up your ROS account, you should register for ROS as soon as possible as it takes about one week to complete. Separate ROS certificates are used for your personal and company logins.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.