Loading

Get Ne Form 36 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE Form 36 online

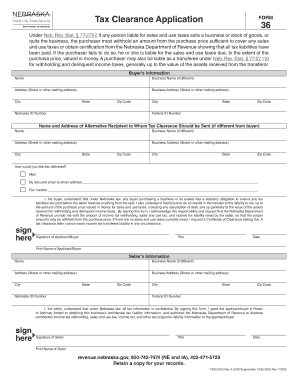

Filling out the NE Form 36 is a crucial step for individuals purchasing a business or its assets in Nebraska. This guide will provide you with detailed, step-by-step instructions on how to complete the form accurately and efficiently online.

Follow the steps to successfully complete the NE Form 36 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Provide the buyer's information, including the name, business name (if applicable), and the mailing address. If the business address differs from the mailing address, ensure both are filled out accurately.

- Enter the Nebraska ID number and federal ID number for the buyer. If the buyer does not have a Nebraska ID, provide the Social Security number.

- Complete the alternative recipient section if you would like the tax clearance sent to a person other than the buyer. Include their name, business name (if applicable), and mailing address.

- Select the preferred delivery method for the tax clearance by checking the appropriate box for mail, secured email, or fax.

- Read the acknowledgment statement carefully. This section outlines the buyer's responsibilities and liabilities under Nebraska law when purchasing a business. Sign and date the application to confirm your understanding.

- Complete the seller's information section, ensuring to provide the same details as required for the buyer including the name, business name, address, and appropriate ID numbers.

- The seller must also sign and date the form. If there are multiple sellers, ensure all authorized individuals sign unless one person is duly authorized to act on their behalf.

- Once all sections are filled out, review the form for accuracy. Save any changes made, and proceed to download, print, or share the completed form as needed.

Complete your NE Form 36 online today to ensure a smooth business purchase process.

Related links form

2023 tax table: married, filing jointly Tax rateTaxable income bracketTaxes owed10%$0 to $22,000.10% of taxable income.12%$22,001 to $89,450.$2,200 plus 12% of the amount over $22,000.22%$89,451 to $190,750.$10,294 plus 22% of the amount over $89,450.24%$190,751 to $364,200.$32,580 plus 24% of the amount over $190,750.3 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.