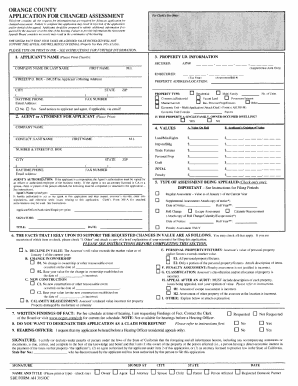

Get Ca Sbe Ah 305/oc 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CA SBE AH 305/OC online

How to fill out and sign CA SBE AH 305/OC online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Obtaining a licensed expert, scheduling a consultation, and visiting the office for a private meeting makes finalizing a CA SBE AH 305/OC from beginning to end daunting.

US Legal Forms assists you in swiftly creating legally-admissible documents based on pre-designed online templates.

Quickly create a CA SBE AH 305/OC without needing to engage professionals. Over 3 million users are already benefiting from our exclusive collection of legal documents. Join us today and access the premier library of browser-based templates. Try it for yourself!

- Locate the CA SBE AH 305/OC you require.

- Access it with a cloud-based editor and begin modifying.

- Complete the empty fields; names of concerned parties, addresses, and numbers, etc.

- Alter the template with intelligent fillable sections.

- Insert the date/time and affix your electronic signature.

- Click on Done after thoroughly reviewing everything.

- Download the prepared documents to your device or print them out as a physical copy.

How to modify Get CA SBE AH 305/OC 2012: personalize forms online

Eliminate the clutter from your documentation routine. Explore the simplest method to locate, modify, and submit a Get CA SBE AH 305/OC 2012.

The task of preparing Get CA SBE AH 305/OC 2012 demands accuracy and concentration, particularly from individuals who are not well-acquainted with this type of work. It is crucial to find an appropriate template and complete it with the correct details. With the proper solution for managing documents, you can have all the tools at your disposal.

It is straightforward to streamline your editing process without acquiring additional skills. Select the right example of Get CA SBE AH 305/OC 2012 and fill it out immediately without toggling between your browser windows. Explore more resources to personalize your Get CA SBE AH 305/OC 2012 form in the editing mode.

While on the Get CA SBE AH 305/OC 2012 page, simply click the Get form button to begin editing it. Input your details into the form directly, as all the key tools are readily available here. The template is pre-made, thus the required effort from the user is minimal. Utilize the interactive fillable fields in the editor to effortlessly finish your documentation. Just click on the form and transition to the editor mode right away. Complete the interactive field, and your document is good to go.

If you need to add notes to specific parts of the document, click on the Sticky tool and place a remark where desired. Frequently, a minor mistake can spoil the entire form when someone fills it out manually. Say goodbye to errors in your documentation. Discover the templates you require in seconds and complete them electronically through a smart editing solution.

- Add more text around the document if necessary.

- Utilize the Text and Text Box tools to insert text in a separate section.

- Incorporate pre-designed graphic elements like Circle, Cross, and Check using the respective tools.

- If required, capture or upload pictures to the document with the Image tool.

- If you wish to draw something in the document, employ Line, Arrow, and Draw tools.

- Experiment with the Highlight, Erase, and Blackout tools to modify the text in the document.

Qualifications for filing an exemption in California can vary based on the type of exemption. Generally, individuals may be eligible based on their age, disability status, or income. It's important to review each exemption's specific requirements to determine your eligibility. For detailed qualifications, refer to the information found in CA SBE AH 305/OC.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.