Loading

Get Form 501 - State Retirement Systems' Of Illinois

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 501 - State Retirement Systems' Of Illinois online

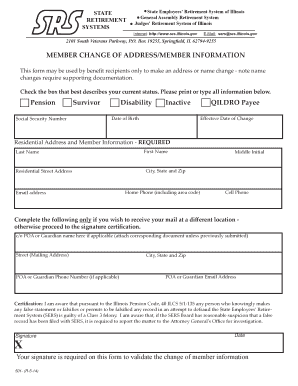

Filling out the Form 501 for the State Retirement Systems of Illinois is an important step for users looking to update their personal information. This guide provides detailed instructions to help you navigate each section of the form efficiently and effectively.

Follow the steps to complete your Form 501 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by checking the appropriate box that reflects your current status, such as 'Pension', 'Survivor', 'Disability', 'Inactive', or 'QILDRO Payee'.

- Enter your Social Security Number and Date of Birth in the designated fields.

- Fill in your Residential Address and Member Information. This includes your Last Name, First Name, Middle Initial, Residential Street Address, City, State, Zip Code, Email Address, Home Phone, and Cell Phone. Ensure all entries are printed clearly or typed.

- If you wish to receive mail at a different location, complete the optional section with the Mailing Address and include the name of your Power of Attorney (POA) or Guardian, if applicable.

- Add the POA or Guardian’s Phone Number and Email Address in their respective fields.

- Review the certification statement indicating awareness of the consequences of falsifying information. Ensure you understand the liability before proceeding.

- Sign the form and include the date to validate your changes.

- After completing the form, save your changes, download, print, or share the document as necessary.

Complete your necessary documents online to ensure your information is up to date.

This publication discusses some tax rules that affect every person who may have to file a fed- eral income tax return. It answers some basic questions: who must file, who should file, what filing status to use, and the amount of the stand- ard deduction. Who Must File explains who must file an in- come tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.