Loading

Get Ie Sarp Employer Return 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE SARP Employer Return online

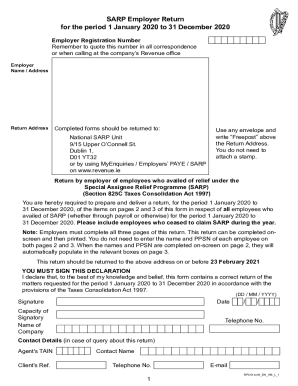

Filling out the IE SARP Employer Return online is a critical task for employers who have employees utilizing the Special Assignee Relief Programme. This guide provides a comprehensive, step-by-step approach to assist you in completing the form accurately and efficiently.

Follow the steps to complete your IE SARP Employer Return online.

- Click ‘Get Form’ button to access the IE SARP Employer Return and open it in your preferred editing tool.

- Begin by entering your employer registration number in the designated field. This number is essential for all related correspondence.

- Provide the employer's name and address as they will appear on formal documentation. Ensure that the information is correct to avoid delays.

- Complete the return address section. Make sure to submit the completed form to the National SARP Unit, as specified.

- Prepare to fill out the employee information section. For each employee who availed of SARP relief during the specified period, include their name, PPSN, and job title.

- Indicate if it is the employee's first year claiming SARP relief. This involves checking the appropriate box.

- List the gross income from employment before any SARP deductions. Be sure to exclude pension contributions and amounts not taxed in the state.

- Mark whether your organization adopted a tax equalization policy for each employee and provide details regarding SARP relief claimed.

- Fill in additional information related to school fees and other costs reimbursed by the employer for employees’ children attending school in the state.

- Record the increase in the number of employees due to SARP and retention figures. This data is critical for the annual SARP report.

- Review all the entered information for accuracy, ensuring no fields are left blank.

- Finally, sign the declaration confirming that, to the best of your knowledge, the information provided is correct. Enter the date, sign, and include the capacity of the signatory.

- Once completed, save any changes made, and proceed to download or print the form if necessary. You can also share it as required.

Complete the IE SARP Employer Return online today to ensure compliance and accurate reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.