Loading

Get Health Equity Hsa Employee Payroll Contribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Health Equity HSA Employee Payroll Contribution Form online

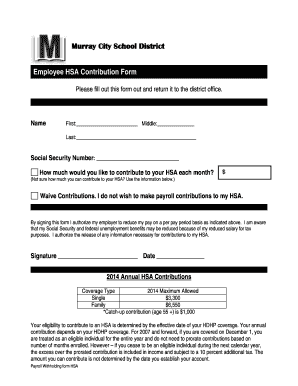

Completing the Health Equity HSA Employee Payroll Contribution Form is essential for managing your health savings account contributions. This guide provides clear, step-by-step instructions to help you fill out the form accurately online.

Follow the steps to complete your Health Equity HSA Employee Payroll Contribution Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your first name, middle initial, and last name in the designated sections. Ensure that this information is accurate, as it will be used for identification purposes.

- Next, input your Social Security number in the appropriate field. This information is required for payroll processing and tax reporting.

- Indicate the monthly contribution amount you wish to make to your health savings account (HSA) by entering a dollar amount in the provided space. If you are unsure about the contribution limits, refer to the guidelines that accompany the form.

- If you choose not to make any contributions to your HSA, select the option to waive contributions. This choice must be clearly indicated on the form.

- Read the authorization statement carefully. By signing the form, you are consenting to a reduction in your pay based on the chosen contribution amount, and you acknowledge the potential impact on your Social Security and federal unemployment benefits.

- Complete the signature section by providing your signature and the date. This finalizes your request for payroll contributions to your HSA.

- Once all sections are completed and reviewed for accuracy, save your changes, and choose to download, print, or share the form as needed.

Start completing your Health Equity HSA Employee Payroll Contribution Form online today.

Update your contributions to your HSA | ADP Intro. Click on the Myself button. Click on the Enrollments button. Click CONTINUE ENROLLMENT. Click CONTINUE. Click the option that makes sense for you. Update to what you'd like the contribution amount to be. Click CONTINUE TO PREVIEW. Click SAVE AND CONTINUE TO NEXT BENEFIT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.