Loading

Get Sdlt1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sdlt1 Form online

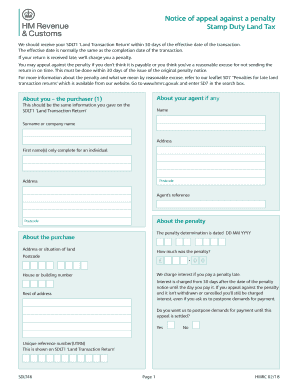

The Sdlt1 Form, also known as the Land Transaction Return, is a crucial document required for reporting land transactions and associated Stamp Duty Land Tax. This guide will assist you in navigating the online process to complete this form correctly and efficiently.

Follow the steps to complete the Sdlt1 Form effectively.

- Click ‘Get Form’ button to obtain the Sdlt1 Form and open it in the designated editor.

- Begin filling out the 'About you – the purchaser' section. Enter your name, surname or company name, complete address, and postcode. For individuals, include first names only.

- If applicable, provide information about your agent in the 'About your agent if any' section. Make sure to include the same details as provided on the Sdlt1 Form.

- In the 'About the penalty' section, enter the penalty determination date in the format DD MM YYYY, the amount of the penalty, and the unique reference number (UTRN) found on the Sdlt1 Form.

- Complete the 'Reason for the appeal' section. Indicate whether you wish to appeal against the penalty by entering X in the appropriate box. Provide additional details if required.

- Sign and date the form at the designated area, ensuring both fields are completed in the format DD MM YYYY.

- Finally, review your entries for accuracy. You can save changes, download, print, or share the completed form as needed.

Start completing your documents online now to ensure timely submission.

What is overseas buyer stamp duty? Stamp Duty Land Tax is a tax paid to HMRC when you buy houses, flats and other land and buildings over a certain price in the UK. The tax is also paid by buyers from overseas (non-UK residents) at a 2% surcharge when buying property in the UK.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.