Loading

Get Form 201

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 201 online

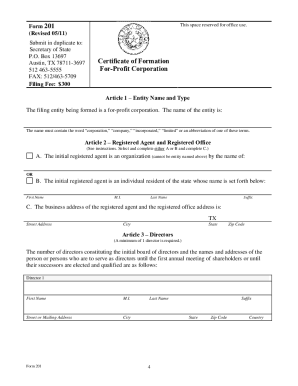

This guide provides clear and comprehensive instructions for filling out Form 201 online, which is used for the formation of a for-profit corporation. By following these steps, users can efficiently navigate the form, ensuring all necessary information is accurately provided.

Follow the steps to complete Form 201 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Article 1—Entity Name and Type: Enter the name of your corporation, ensuring it includes the words ‘corporation,’ ‘company,’ ‘incorporated,’ ‘limited,’ or an abbreviation of one of these terms. Verify that the chosen name is unique by checking against existing businesses to avoid conflicts.

- Article 2—Registered Agent and Registered Office: Select either option A (business entity) or option B (individual). Enter the registered agent's name and the registered office address where service of process can be delivered during normal business hours. Ensure that the registered office is not solely a mailbox service.

- Article 3—Directors: List a minimum of one director by providing their name and address. Ensure you do not use prefixes and keep privacy in mind by using a business address if necessary.

- Article 4—Authorized Shares: Specify the total number of shares and choose between option A (par value) or option B (no par value). If applicable, detail any classes of shares and their respective rights in the supplemental information section.

- Article 5—Purpose: Describe the general purpose of your corporation, stating it is for any lawful business under the Texas Business Organizations Code.

- Supplemental Provisions/Information: Use this section for any additional text or articles. If the corporation is to have a limited duration, specify this here.

- Organizer: Provide the name and address of the organizer who will submit this form.

- Effectiveness of Filing: Select how and when the filing will become effective, either immediately, on a specified future date, or contingent on a future event.

- Execution: The organizer must sign and date the form, affirming the accuracy of the information and consent of the registered agent. Review the document carefully before submission.

- Once completed, save your changes, download, print, or share the form as needed for further processing.

Start completing your Form 201 online today to establish your for-profit corporation efficiently.

The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203. However, if you both choose to file a joint New York State return, use Form IT-201; both spouses' income will be taxed as full-year residents of New York State.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.