Loading

Get Notification Of Policy Update - Ohio Bureau Of Workers ... - Bwc State Oh

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Notification Of Policy Update - Ohio Bureau Of Workers ... - Bwc State Oh online

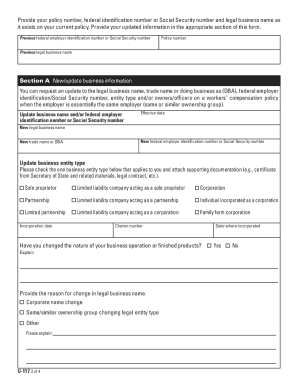

This guide provides a clear, step-by-step approach to filling out the Notification of Policy Update form for the Ohio Bureau of Workers' Compensation. It is designed to assist users in understanding each part of the form to ensure accurate completion online.

Follow the steps to complete your form accurately.

- Click the ‘Get Form’ button to access the form and open it in the designated editing tool.

- Carefully review the purpose of the form: to notify the Bureau of Workers' Compensation of any updates to your workers' compensation policy. Ensure you understand the sections that need completion.

- Begin with Section A to update your business information. Provide your legal business name, trade name if applicable, entity type, and details of owners or officers as necessary.

- In Section B, update your address and contact information. Include the primary physical address where risk management services will be handled and ensure the correct contact details are provided.

- If you need to cancel elective coverage, complete Section C. List the individual whose coverage is being canceled and the effective date of that cancellation.

- For Section D, if workers’ compensation coverage is no longer needed, specify the reason and ensure all necessary details are included regarding your operations.

- If applicable, complete Section E regarding any coverage from other states for employees working outside of Ohio.

- Proceed to Section F to sign and date the form. This signature certifies the accuracy of the information provided.

- Finally, save changes to the form. You can download, print, or share the completed notification form as needed.

Take action now and complete your Notification of Policy Update online to ensure your records are accurate and up-to-date.

The penalty for failure to file a payroll report on time is 1 percent ($3 minimum - $15 maximum) of the premium due. Failure to pay premium on time will result in a $30 flat penalty charge as well as a penalty charge of up to 15 percent of the premium due depending on how late the payment is received.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.