Loading

Get Nys Vs-1 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYS VS-1 online

Filling out the New York State VS-1 form online is a straightforward process that requires careful attention to detail. This guide provides step-by-step instructions to ensure that every part of the form is completed correctly, making the application process seamless for all users.

Follow the steps to successfully complete the NYS VS-1 form online.

- Press the ‘Get Form’ button to access the NYS VS-1 and open the form in your selected document management program.

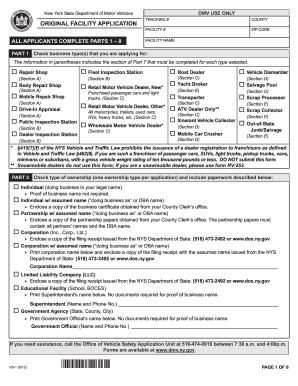

- In Part 1, check the business types you are applying for by selecting the appropriate boxes listed. Familiarize yourself with the sections that correspond to each type.

- In Part 2, indicate the type of ownership by choosing one option and ensure you gather and attach the necessary documentation for your selected ownership type.

- In Part 3, provide the business name, address, phone number, and email address accurately to ensure effective communication.

- Complete Part 4 with ownership information. Depending on the type of ownership, attach relevant identification and provide required information like names, addresses, and Social Security numbers.

- In Part 5, answer all questions truthfully regarding previous licenses, convictions, financial interests, and any employees related to your business.

- For Part 6, confirm the business property arrangements, indicating whether you own or lease the property and providing relevant details.

- In Part 7, complete the sections applicable to the business type(s) chosen earlier. Ensure you understand the specific requirements and fees for each type.

- In Part 8, certify that all information provided is true and sign the application. Don't forget to review the requirement checklist to ensure all aspects of the application are complete.

- Once all sections are filled out accurately, save your changes, and download or print the completed form for submission.

Complete your NYS VS-1 application online today for a smooth processing experience.

The number of NYS allowances you should claim depends on your unique financial situation, including dependents and tax credits. Claiming the right amount ensures you do not face a large tax bill or refund. Consider using NYS VS-1 for personalized guidance on how to determine your allowances effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.