Loading

Get Eligibility Matrix

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Eligibility Matrix online

The Eligibility Matrix is a crucial document for determining the eligibility of various mortgage products. This guide provides clear instructions on how to fill out the form online, ensuring you have all the necessary information to submit accurately.

Follow the steps to complete the Eligibility Matrix with ease.

- Press the ‘Get Form’ button to access the Eligibility Matrix and open it in your chosen editor.

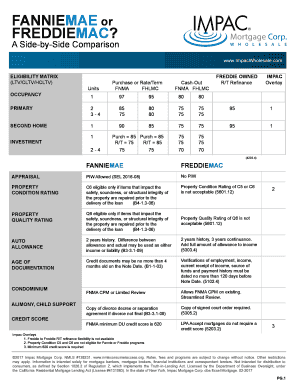

- Begin by filling out the section for occupancy, indicating whether the property is a primary residence, second home, or investment property. Ensure you provide the correct number of units.

- Next, input the loan-to-value (LTV), combined loan-to-value (CLTV), and home equity loan-to-value (HCLTV) ratios relevant to your situation based on whether you are purchasing or refinancing.

- Complete the appraisal section by checking the property condition rating and ensuring you comply with the requirements for the property quality rating.

- Fill in the necessary details for any commission income, disputed accounts, and multiple financed properties. Be sure to check the specific guidelines for Fannie Mae and Freddie Mac.

- Review the documentation requirements, including any necessary credit score information and asset declarations.

- Before finalizing, ensure that all data is accurately entered and review the eligibility criteria applicable to your financial situation.

- Once all sections are completed, save your changes, and you will have the option to download, print, or share the completed form.

Complete your Eligibility Matrix online today for a streamlined mortgage process.

The Consumer Financial Protection Bureau (CFPB) recommends a maximum 43% DTI ratio, but lenders may make exceptions if you have high credit scores or extra savings. → The occupancy of the house you're refinancing. Most borrowers take out cash against their primary residence, that is, the home they live in.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.