Loading

Get Florida Consumer S Certificate Of Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Florida Consumer S Certificate Of Exemption online

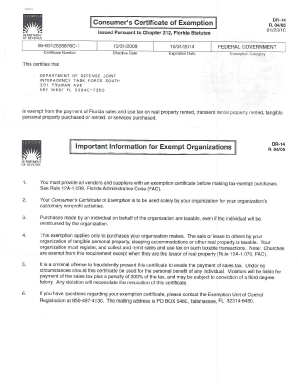

Filling out the Florida Consumer S Certificate Of Exemption is a straightforward process that allows eligible users to apply for an exemption. This guide will provide you with step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete your certificate of exemption form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Once the form is open, review the top section, which generally requires your name, mailing address, and contact information. Fill in these fields with accurate information, ensuring that you check for any required fields marked clearly.

- In the subsequent section, indicate the reason for your exemption by selecting the appropriate option. This might include categories such as charitable organizations or government entities. Make sure to provide any supporting information as specified.

- Next, you may need to provide documentation to support your claim. Attach any relevant files or evidence per the instructions given on the form.

- After completing all sections, review the information entered to verify accuracy. This is an important step to avoid any delays in processing your exemption.

- Finally, save your changes, and choose whether to download, print, or share the form as needed. Ensure that you retain a copy for your records.

Start completing your Florida Consumer S Certificate Of Exemption online today.

Phone: 877-FL-RESALE (877-357-3725) and enter the customer's Annual Resale Certificate number. Online: Go to the Seller Certificate Verification application and enter the required seller information for verification.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.