Loading

Get Tx Form 5871 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Form 5871 online

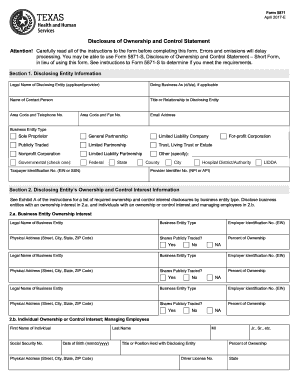

Completing the TX Form 5871, the Disclosure of Ownership and Control Statement, is essential for applicants and providers submitting information related to ownership and control interests. This guide provides a clear and comprehensive overview to assist users in filling out the form efficiently online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the designated space.

- In Section 1, provide the disclosing entity's legal name, doing business as name if applicable, and contact information including telephone number and email address. Also, specify the business entity type and taxpayer identification number.

- For Section 2, disclose the ownership and control interest. In 2.a, list the names and details of business entities with ownership interest, including their type, tax identification number, and percent of ownership.

- In Section 2.b, input details regarding individuals with an ownership or control interest, including their physical address, date of birth, and position with the disclosing entity.

- Proceed to Section 3 to disclose the next level of ownership and control interests, repeating the necessary information for business entities and individuals, as required.

- In Sections 4, 5, and 6, if applicable, provide information pertaining to any management companies that are associated with the disclosing entity, following the same format for ownership disclosures.

- In Section 7, answer questions related to any other ownership and control interests, detailing specifics if any business entities or individuals listed have overlapping interests.

- Complete Section 8 by answering general disclosure questions regarding legal, regulatory, and ownership issues that might impact the disclosing entity.

- Finally, ensure all information is accurate, sign the certification in Section 9, and provide your printed name, title, and date signed.

- After filling out the form, you can save changes, download, print, or share the document as needed.

Take the next step and complete your TX Form 5871 online today.

A disclosure of ownership form is a document that helps clarify the legal ownership of a vehicle. This form provides important details about the former and current owners, ensuring transparency in the ownership process. The TX Form 5871 contains relevant sections where you can include this information to facilitate a clear title transfer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.