Loading

Get Form 15c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 15c online

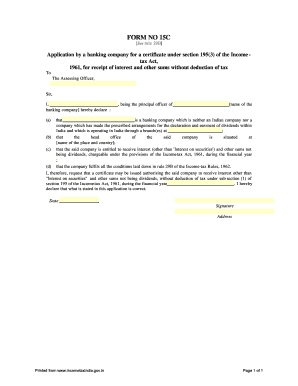

Form 15c is an application by a banking company for a certificate under section 195(3) of the Income Tax Act, 1961. This guide provides step-by-step instructions for effectively filling out the form online, ensuring you provide all necessary information accurately.

Follow the steps to complete Form 15c online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name of the banking company in the space provided. Ensure the name is correct and matches your official documents.

- Indicate that the banking company is neither an Indian company nor has made arrangements for declaring and paying dividends within India. This is an important declaration.

- Enter the details of the branch or branches in India where the company operates. Be precise about the locations.

- Provide the name of the place and country where the head office of the company is situated. This should reflect the official registered address.

- Specify the financial year during which the company is entitled to receive interest and other sums. Make sure the dates align with the current regulations.

- Confirm that the company meets all conditions laid out in rule 29B of the Income Tax Rules, 1962. Review the criteria carefully to ensure compliance.

- Write a declaration stating that all information provided in the application is correct. This is a legal affirmation of the accuracy of your submission.

- Enter the date of application in the specified format.

- Sign the form digitally or print to sign physically, and ensure your signature matches any previously submitted documents.

- Complete the address section as required. This may include your official address or the address where the application is being submitted.

- Once you have filled out all sections, you can save changes, download, print, or share the completed form as needed.

Begin the process now by completing Form 15c online.

Section 15- 15 (Profit-making undertaking or plan) of the Income Tax Assessment Act 1997 applies to a profit arising in the 1997-98 income year or a later income year, even if the undertaking or plan was entered into, or began to be carried on or carried out, before the 1997-98 income year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.