Loading

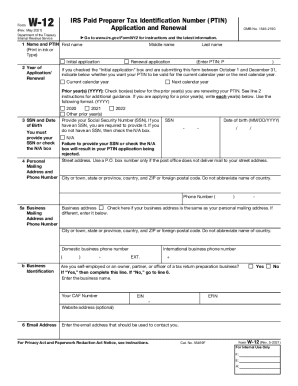

Get Irs W-12 2021-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-12 online

The IRS W-12 form is essential for individuals applying for or renewing their Paid Preparer Tax Identification Number (PTIN). This guide provides a clear and supportive overview of how to complete the form accurately online, ensuring you comply with all requirements.

Follow the steps to fill out the IRS W-12 online.

- Click ‘Get Form’ button to access the W-12 form and open it in the online editor.

- Provide your full name in the designated fields, including first name, middle name (if applicable), and last name. Indicate whether this is an initial or renewal application by checking the appropriate box.

- Enter your Social Security Number (SSN) and date of birth. If you do not have an SSN, check the N/A box.

- Fill out your personal mailing address, ensuring that you include city or town, state, and ZIP code. Provide a contact phone number.

- If you have a business address different from your personal address, provide that information here. Indicate if your business address is the same as your personal mailing address.

- If you are self-employed or part of a tax return preparation business, indicate your role and provide the business name along with any business identification numbers.

- Answer whether you have been convicted of a felony in the past 10 years. If 'Yes,' provide additional details.

- Enter the address used on your last U.S. individual income tax return, or check the box if you have never filed a U.S. tax return.

- Select your filing status on your last U.S. individual income tax return and enter the tax year.

- Confirm that you are current on both individual and business federal taxes.

- Acknowledge your understanding of data security responsibilities as a paid tax preparer.

- List any professional credentials you hold, ensuring that you provide the necessary details and expiration dates.

- Sign and date the application. Remember that the application fee of $35.95 must be included with your application.

- Review all sections for accuracy before submitting. Save your changes, and then choose to download, print, or share the completed form.

Complete your IRS W-12 application online to ensure a smooth submission process.

Answer: To access your online PTIN account, go to the PTIN system login page. Then click “Log In”. Enter your User ID and Password in the designated fields, click “Log In”.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.