Loading

Get Pte 84-24 Disclosure And Acknowledgment Form For Ira ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PTE 84-24 Disclosure And Acknowledgment Form For IRA online

Filling out the PTE 84-24 Disclosure and Acknowledgment form is crucial for those considering an annuity contract transaction involving Individual Retirement Account funds. This guide will help you navigate each section of the form, ensuring a smooth and informed completion process.

Follow the steps to fill out the form accurately and efficiently.

- Press the ‘Get Form’ button to access the PTE 84-24 Disclosure and Acknowledgment form. This will allow you to open and review the document online.

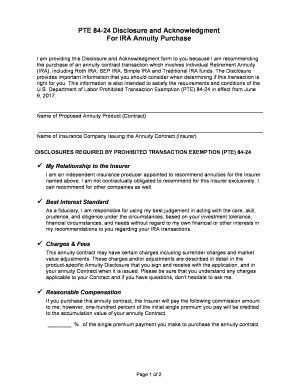

- Begin by filling in the proposed annuity product's name and the name of the insurance company issuing the annuity. These details are essential for identification.

- Review the disclosures required by the Prohibited Transaction Exemption (PTE) 84-24. This includes understanding your relationship to the insurer and the best interest standard outlined.

- Ensure you comprehend the charges and fees associated with the annuity contract. This includes any surrender charges and market value adjustments that may apply.

- Acknowledge any potential material conflicts of interest. This section highlights situations where financial interests may affect recommendations.

- Complete the Disclosure Certification by signing where indicated. This confirms that you believe the producer has acted in your best interest and provided accurate information.

- Proceed to the Acknowledgment and Transaction Acceptance section. Here, you will provide your printed name, date, and signature, indicating your understanding and acceptance of the document.

- Once all fields are completed, save your changes, then choose to download, print or share the form as required.

Start filling out your PTE 84-24 Disclosure and Acknowledgment form online today!

This Disclosure and Acknowledgment Form (“Form”) provides important information You should know before making a purchase of, and additional payment(s) to, an annuity/ life insurance contract issued by the Insurance Company (“Insurance Company”) with IRA or employee benefit plan funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.