Loading

Get Mortgage Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Application Form online

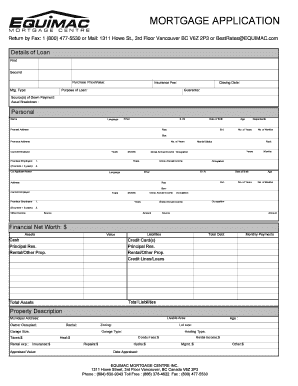

Filling out a mortgage application form online can be a straightforward process when guided correctly. This document provides detailed instructions on each section of the form to help users navigate the process with confidence.

Follow the steps to successfully complete your online mortgage application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your details in the 'Details of Loan' section. Input the purchase price or value of the property, the type of mortgage you are applying for, and additional information such as the insurance fee and closing date.

- Fill out the 'Personal' section with your name, language preference, social insurance number, email, date of birth, current and previous addresses, your marital status, and details about your current and previous employment.

- If applicable, complete the 'Co-Applicant' section with the same type of personal information for your co-applicant. Ensure accuracy in their gross annual income and employment details.

- In the 'Financial Net Worth' section, provide details about your assets, liabilities, monthly payments, and your total net worth.

- Provide the relevant property description, including livable area, municipal address, property type, garage size, taxes, appraised value, heating type, and any rental income details.

- Complete the 'Credit References' section with information about your bank accounts and any existing loans. Include the account numbers, outstanding balances, limits, and monthly payments.

- Detail any existing mortgages or properties in the 'Existing Mortgages / Properties' section, ensuring to specify the lender, property addresses, and pertinent values.

- If refinancing, provide information in the 'Refinance Information' section about the original purchase date, purpose of the refinancing, improvements made, and original mortgage details.

- Review all information for accuracy before signing. Confirm that the information provided is true and correct. Sign and date the application for both the applicant and co-applicant.

- Finally, save your changes, and choose to download, print, or share the completed form as necessary.

Begin your mortgage application process online today.

The URLA is much longer than before. It is now 9 pages. The redesigned URLA will replace Freddie Mac Form 65 and Fannie Mae Form 1003 and will require lenders to request more borrower information than ever.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.