Loading

Get Form 480 60 Ec

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 480 60 EC online

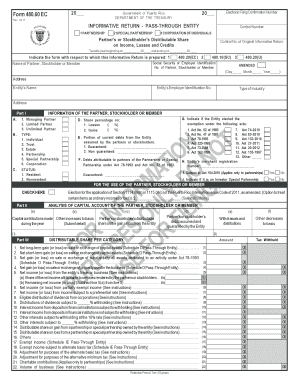

Filling out the Form 480 60 EC is essential for partnerships, special partnerships, corporations of individuals, and limited liability companies in Puerto Rico. This guide provides a clear, step-by-step process to help users complete the form accurately and efficiently online.

Follow the steps to complete Form 480 60 EC online successfully.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the Electronic Filing Confirmation Number. This is a unique number provided by the Department of the Treasury upon filing.

- Enter the control number assigned to the entity filling out the form. This ensures proper identification of the entity.

- Indicate the taxable year by filling in the starting and ending dates. This helps define the reporting period.

- Select the applicable form by marking the relevant box that corresponds to the informative return being prepared.

- Provide the name and address of the partner, stockholder or member, including their Social Security or Employer Identification Number.

- Indicate the type of partner by selecting from the given options, whether they are an individual, trust, estate, etc.

- Specify the share of losses and gains for the partner or stockholder, ensuring accuracy in reporting their distributable share.

- Complete the analysis of capital account section by entering contributions, distributions, and shares of income or loss.

- Review all completed sections for accuracy before proceeding to save your progress.

- Once everything is filled out and correct, save the changes, download, print, or share the form as required.

Complete your Form 480 60 EC online today for a smoother filing experience.

The easiest way to determine how you should file is by using the free eFile.com FILEucator. A Puerto Rico tax return reporting Puerto Rico income and a U.S. tax return is reflected on Form 1040-NR - FileIT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.