Loading

Get Ks K-cns 100 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS K-CNS 100 online

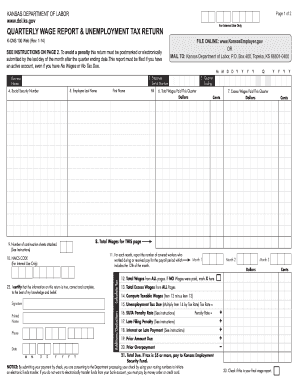

The KS K-CNS 100 is a crucial document for employers in Kansas to report quarterly wages and unemployment taxes. This guide will help you navigate and complete the form accurately, ensuring compliance and avoiding penalties.

Follow the steps to accurately complete the KS K-CNS 100 form online.

- Click the ‘Get Form’ button to obtain the KS K-CNS 100 and open it in your preferred editing tool.

- Enter your business name in the designated field. Make sure to spell it correctly as it will be used for official purposes.

- Provide your employer serial number in the next field. This number is essential for identifying your account.

- Fill in the quarter ending date in the format MM/DD/YYYY. For example, use '03/31/2023' for the first quarter.

- List your employees' social security numbers and names, including last name, first name, and middle initial.

- Report the total wages paid to each employee during the quarter in the appropriate column. Ensure that this amount reflects actual wages paid.

- Calculate and enter any excess wages paid this quarter, which applies to wages over the $8,000 threshold for each employee.

- Summarize total wages and excess wages for this page, ensuring accuracy for your records.

- If you have multiple pages or continuation sheets, indicate how many are attached in the respective field.

- Complete your NAICS code if applicable, and provide information on the number of covered workers for each month.

- Certify the information provided by signing your name and include your printed name, phone number, and the date.

- Review all entries for accuracy and completeness to avoid potential issues with the submission.

- Finally, save your changes, download a copy of the form for your records, and submit it electronically to ensure timely filing.

Complete your KS K-CNS 100 form online today to ensure compliance and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Setting up a Kansas withholding account involves registering with the Kansas Department of Revenue. Employers should fill out the necessary forms, including the KS K-CNS 100, to outline their payroll needs. Completing this step allows you to correctly withhold and remit taxes. For additional support and streamlined processes, uslegalforms offers user-friendly resources that can aid in setting up your account quickly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.