Loading

Get Calhfa Borrower Affidavit Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Calhfa Borrower Affidavit Form online

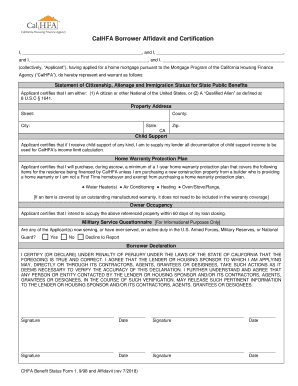

The Calhfa Borrower Affidavit Form is a crucial document for individuals applying for a home mortgage through the California Housing Finance Agency. This guide will provide you with clear and detailed instructions on how to complete the form online.

Follow the steps to successfully complete the Calhfa Borrower Affidavit Form.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by filling out the initial section with your full name and that of your co-applicants, if applicable. This information identifies all parties involved in the mortgage application.

- Next, complete the statement of citizenship, alienage, and immigration status. Choose the option that accurately reflects your status from the provided choices.

- In the property address section, input your street address, county, city, state (California), and zip code. Ensure this information is complete and accurate.

- If you receive any form of child support, indicate this in the child support section. You are required to provide all necessary documentation for the lender.

- In the home warranty protection plan section, confirm your intention to purchase a minimum of a 1-year warranty for the residence, unless exempt due to specific conditions.

- Confirm your intent to occupy the property within 60 days of loan closing in the owner occupancy section.

- Address the military service questionnaire by selecting yes, no, or decline to report based on your service status.

- Finally, review and complete the borrower declaration. You will need to sign and date the form, ensuring that all information provided is true and accurate.

- Once all sections are completed, save your changes. You can download, print, or share the form as needed.

Proceed to complete your Calhfa Borrower Affidavit Form online for your mortgage application.

While you can make payments on the loan to reduce accrued interest, or principal, no payments are required until the loan is called due, at maturity of the first, sale of the property, transfer of title, a refinance or assumption of the first.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.