Loading

Get 1998 Instructions 2220

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1998 Instructions 2220 online

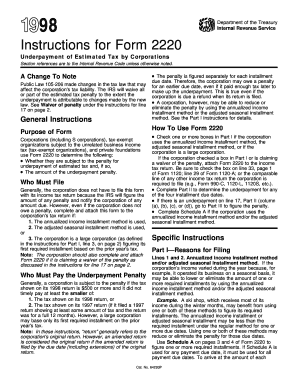

Filling out the 1998 Instructions 2220 online is an essential step for corporations and tax-exempt organizations to assess their estimated tax obligations. This guide will provide a clear, step-by-step approach to navigating the form effectively, ensuring compliance while minimizing any potential penalties.

Follow the steps to successfully complete the 1998 Instructions 2220 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully read through the purpose of Form 2220 to understand if your corporation is subject to the penalty for underpayment of estimated tax. It is essential to assess your corporation's tax liability before proceeding.

- Identify if your corporation must file this form. Generally, the corporation does not need to submit this form with its income tax return unless using specific payment methods or claiming a waiver of penalty.

- If applicable, mark the appropriate boxes in Part I based on your corporation’s use of the annualized income installment method, adjusted seasonal installment method, or if you qualify as a large corporation.

- Move to Part II to determine any underpayment for your corporation's estimated taxes due on the relevant dates. Fill in tax amounts and any necessary adjustments.

- If there is an underpayment, proceed to Part III to calculate the underpayment penalty. Follow the outlined instructions carefully to avoid errors.

- Complete either Schedule A or the relevant calculations based on your chosen payment method and document your figures.

- Review all entries for accuracy and completeness. Ensure that all necessary sections of the form are filled out before submitting.

- After completing the form, save your changes. You may then download, print, or share the form as needed based on your filing requirements.

Get started by filling out the 1998 Instructions 2220 online today!

Answer and Explanation: In order to avoid underpayment penalty, Paul must pay the lesser of 90% of the the current year tax ($33,793*0.9 = $30,414) or 100% of prior years tax ($29,000).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.