Loading

Get Mo Dor Mo-atc 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-ATC online

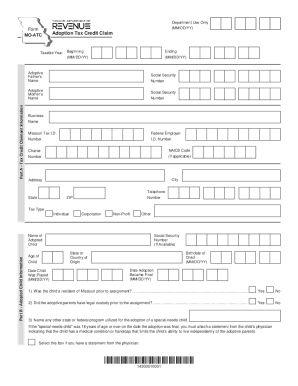

The MO DoR MO-ATC form is crucial for claiming the adoption tax credit in Missouri. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete the MO DoR MO-ATC form online.

- Click the ‘Get Form’ button to access the MO DoR MO-ATC online and open it in the editor.

- Begin with Part A, where you need to enter the tax credit claimant's information including names, social security numbers, business name, Missouri tax ID, and contact details. Be sure to select the appropriate tax type: individual, corporation, non-profit, or other.

- Move on to Part B, which requires details regarding the adopted child. Fill in the child’s name, age, placement date, birthdate, state or country of origin, and the date the adoption became final. Additionally, answer the questions regarding residency and custody by selecting 'Yes' or 'No' as applicable.

- In Part C, detail the nonrecurring adoption expenses. Enter amounts for adoption fees, court costs, attorney fees, and any other related expenses. Ensure the total does not exceed the maximum of $10,000.

- Continue in Part C by filling out Lines 6 through 12, which involve entering amounts paid by various sources towards the adoption expenses and calculating the specific tax credit you are eligible for.

- In Part D, confirm that the stated adoption expenses will not be reimbursed by other programs and provide the necessary signature and date.

- Finally, in Part E, the agency must certify the child as a special needs child. Ensure this section is completed and signed appropriately if it applies to your adoption case.

- Review all sections for accuracy, then save your changes, and once satisfied, you can download, print, or share the completed form.

Complete the MO DoR MO-ATC form online today to take the next step in claiming your adoption tax credit.

When your sales tax return has been filed, but not paid by the required due date, you should calculate your penalty by multiplying the tax amount due by 5 percent. This penalty does not increase.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.