Loading

Get Nr301

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nr301 online

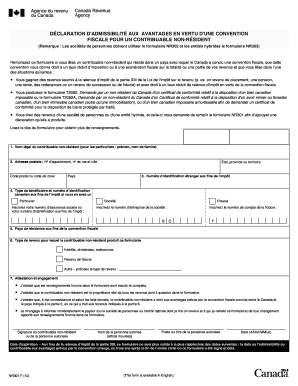

The Nr301 form is essential for non-resident taxpayers who reside in a country with which Canada has a tax treaty. This guide provides a step-by-step approach to completing the form online, ensuring you understand each component clearly and accurately.

Follow the steps to complete the Nr301 form online:

- Press the ‘Get Form’ button to access the Nr301 form and open it in the editing platform.

- Enter the legal name of the non-resident taxpayer. For individuals, include first name and last name.

- Provide the mailing address, including the apartment number, street number, and city.

- Indicate the type of beneficiary and provide the Canadian tax identification number if available. This can be a social insurance number for individuals or the business number for corporations.

- Fill in the foreign tax identification number and the country of issuance.

- Specify the country of residence for tax purposes as defined by the tax treaty.

- Choose the type of income for which the non-resident is submitting this form, including options such as interest, dividends, royalties, or other income types.

- Complete the attestation and commitment section to affirm that the provided information is accurate and to confirm the non-resident is the actual owner of the income.

- Sign and date the form, ensuring that either the non-resident taxpayer or an authorized person completes this section.

- Finally, save your changes, download the form for your records, print it, or share it as needed.

Start completing your Nr301 form online today for a smoother tax process.

Form NR301 is a declaration statement for non-resident taxpayers, resident of a country that Canada has a tax treaty with, to claim reduced tax rates or exemptions provided by the applicable tax treaty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.