Loading

Get 1099 R

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099 R online

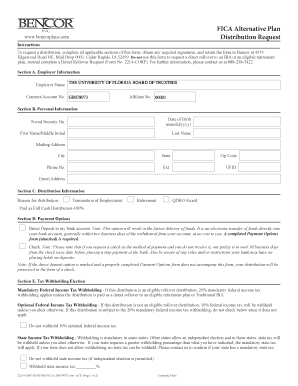

The 1099 R form is crucial for reporting distributions from retirement accounts. This guide will provide you with comprehensive, step-by-step instructions for completing this important financial document online.

Follow the steps to effectively fill out the 1099 R form.

- Click ‘Get Form’ button to access the 1099 R form and open it within your online editor.

- Begin with Section A, where you will enter the payer’s information, including the payer's name and identifying details. Make sure to accurately provide this information as it is essential for tax reporting.

- Move to Section B to fill in your personal information. This includes your Social Security number, date of birth, name, mailing address, and email address. Double-check for accuracy to avoid processing delays.

- In Section C, indicate the reason for the distribution, such as retirement or termination of employment. Select the appropriate option that reflects your situation.

- Proceed to Section D to choose your payment options. You can opt for direct deposit or a check. If you choose direct deposit, ensure to include all necessary banking information as specified.

- Review Section E regarding tax withholding elections. Indicate if you want federal and state taxes withheld from your distribution. Understanding the implications here is essential, so refer to guidance specific to your situation if needed.

- Finally, in Section F, you will need to provide your signature, affirming that all information is correct. Include the date and ensure that you keep a copy for your records.

- After completing all sections, save your changes. You can then download, print, or share the completed 1099 R form as required.

Complete your 1099 R form online to ensure timely and accurate tax reporting.

1099-R forms are a type of form 1099 used for reporting distributions from a retirement or tax-deferred account, such as an IRA, 401(k) or annuity, during the tax year. ... Investors receive form 1099-R when there is any form of distribution from a retirement account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.