Get Ira Distribution Request Form 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRA Distribution Request Form online

Completing the IRA Distribution Request Form online can streamline your process for accessing funds from your Individual Retirement Account. This guide provides step-by-step instructions to help you fill out the required fields with confidence.

Follow the steps to complete your IRA Distribution Request Form online.

- Click ‘Get Form’ button to access the IRA Distribution Request Form. This will open the form in an easily accessible editor for online completion.

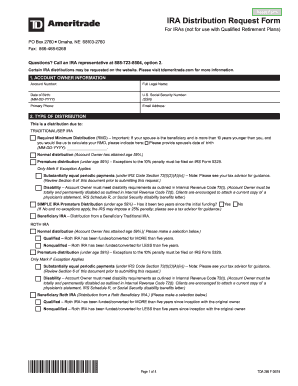

- Enter your account owner information in the designated fields. This includes your account number, full legal name, date of birth, U.S. social security number, primary phone number, and email address.

- Indicate the type of distribution you are requesting by marking the appropriate box. Options include traditional/SEP IRA distributions, Roth IRA distributions, or direct rollovers. Be sure to provide any necessary additional information, such as your spouse’s date of birth if applicable.

- Specify the distribution amount and frequency. Here you can request a required minimum distribution (RMD), total distribution, or a partial cash distribution. Fill in the exact amount for partial distributions and select a frequency for recurring distributions if desired.

- Choose the distribution method that suits your needs. Options include internal transfers, checks, wire transfers, or ACH deposits. Make sure to fill out any required details for the chosen method.

- Complete the tax withholding election. This is mandatory as per IRS regulations. Choose whether you want federal and state income tax withheld from your distribution and provide the necessary percentage or amount if applicable.

- Review the 72(t) substantially equal periodic payments exceptions and ensure you understand the rules associated with them if applicable to your situation.

- Sign and date the form at the bottom. Ensure the original signature is included, as electronic signatures are not authorized. After completing the form, you can save changes, download, print, or share the finalized document.

Complete your IRA Distribution Request Form online today to expedite your distribution process.

A withdrawal generally refers to any removal of funds from your account at any time. A distribution, however, specifically pertains to withdrawals made under the rules set for retirement accounts, often after reaching a certain age or under particular circumstances. Understanding this distinction is crucial, especially when completing the IRA distribution request form. Proper terminology helps ensure that you are following the right procedures and regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.