Loading

Get Forbearance Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Forbearance Fillable Form online

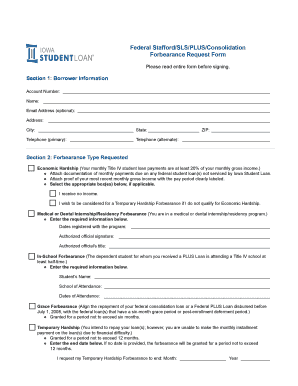

Completing the Forbearance Fillable Form online is an important step for borrowers facing financial difficulties. This guide will walk you through each section of the form, ensuring you provide the necessary information accurately and efficiently.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to obtain the Forbearance Fillable Form and open it for editing.

- In Section 1, provide your Borrower Information. Fill in your Account Number, Name, Email Address (optional), Address, City, State, ZIP, and both primary and alternate Telephone numbers.

- Navigate to Section 2, where you will select the Forbearance Type Requested. Choose the appropriate option based on your situation, such as Economic Hardship or In-School Forbearance, and fill in the required documentation if applicable.

- For Economic Hardship, attach documentation proving your monthly payments and your most recent gross income, if applicable. Indicate if you wish to be considered for a Temporary Hardship Forbearance.

- If you are in a Medical or Dental Internship/Residency, complete the relevant fields with the dates registered and the authorized official's signature and title.

- Complete the details under In-School Forbearance, entering the Student's Name, School of Attendance, and Dates of Attendance.

- For Temporary Hardship, provide an end date for the forbearance period if applicable; otherwise, it will automatically end in 12 months.

- In Section 3, review the Comaker Information and include necessary details if applicable. Ensure both signatures are provided if a comaker is involved.

- In Section 4, read through the Forbearance Agreement carefully. Sign and date the form in the designated areas.

- After fully completing the form, save your changes, download a copy for your records, and print or share the form as needed.

Begin filling out your Forbearance Fillable Form online today.

It is a form of repayment relief granted by the lender or creditor in lieu of forcing a property into foreclosure. Loan owners and loan insurers may be willing to negotiate forbearance options because the losses generated by property foreclosure typically fall on them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.