Loading

Get Form 15111

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 15111 online

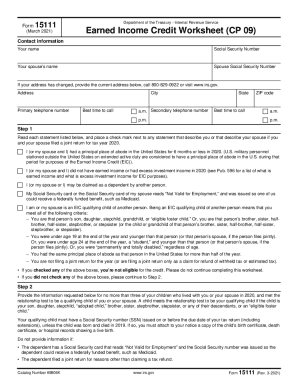

Filling out Form 15111, the Earned Income Credit Worksheet, is an important step in determining your eligibility for the credit. This guide provides a clear and supportive walkthrough for completing the form online, ensuring you understand each section and field.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to acquire the form and open it in your online editor.

- Provide your name and Social Security number in the designated fields, along with your spouse’s name and Social Security number if applicable.

- If your address has changed, be sure to input your current address, primary and secondary telephone numbers, and specify the best times to call.

- Read through the statements in Step 1. Carefully check any that apply to you or your spouse if filing jointly, indicating your eligibility for the credit.

- Move on to Step 2. Enter the information for up to three qualifying children who lived with you or your spouse during the year, ensuring you include their names and Social Security numbers.

- Answer the yes/no questions for each dependent regarding residency, student status, and age in Step 2.

- In Step 3, review your answers to determine whether each dependent meets the requirements for the credit. Keep track of how many dependents qualify.

- If at least one dependent qualifies, proceed to Step 4. If not, you may need to stop here. In Step 4, you and your spouse, if applicable, will need to sign and date the form to declare the information provided is accurate.

- Once all details are filled in and verified, save your changes, and choose to download, print, or share the completed form as needed.

Complete your Form 15111 online today to ensure you receive any credits you may be eligible for.

IRS uses both internal information and information from external sources such as other government agencies. ... If the review shows questionable or incomplete information, the IRS holds the EITC portion of the taxpayer's refund and contacts the taxpayer to verify the information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.