Loading

Get Irc501c3 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irc501c3 Form online

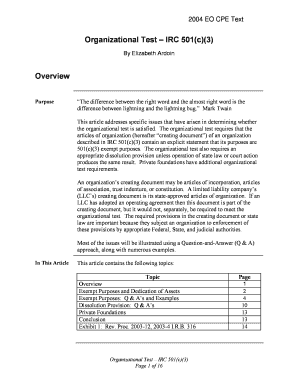

Filling out the Irc501c3 Form online is a crucial step for organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This guide will provide clear, step-by-step instructions to ensure that your organization meets all the necessary requirements for successful filing.

Follow the steps to fill out the Irc501c3 Form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the form's introductory information carefully. Ensure you understand the purpose of the form and the organizational test requirements for 501(c)(3) status.

- Fill out the organization's name and address in the designated fields. Ensure that the information is accurate and up-to-date.

- In the purpose section, clearly state the exempt purposes of your organization as defined under IRC 501(c)(3). You may use terms such as charitable, educational, or religious.

- Provide a detailed description of the activities your organization will engage in to further its exempt purposes. Be specific and ensure activities are in line with the stated purposes.

- Include a dissolution provision that specifies how the organization’s assets will be distributed upon dissolution. This provision must state the assets will be permanently dedicated to exempt purposes.

- Review all the information entered on the form for accuracy and completeness. Ensure that all required fields are filled out.

- Once you have completed and reviewed the form, you can save your changes, download the form for your records, print a hard copy, or share it as necessary.

Start filling out your Irc501c3 Form online today to secure your tax-exempt status!

Difference Between 501c and 501c3 Both types of organization are exempt from federal income tax, however a 501(c)3 may allow its donors to write off donations whereas a 501(c) does not.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.