Loading

Get Ca Ftb Schedule D-1 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB Schedule D-1 online

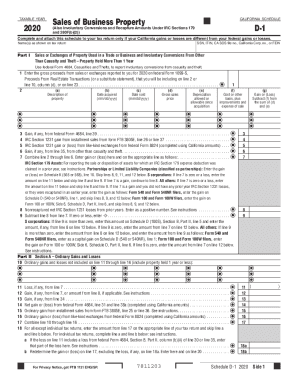

This guide provides a clear and supportive approach to filling out the California FTB Schedule D-1 online. The Schedule D-1 form is essential for reporting gains or losses from the sale of business property and other related transactions, especially when California amounts differ from federal amounts.

Follow the steps to complete your Schedule D-1 efficiently.

- Use the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your name(s) as shown on your tax return at the top of the form.

- Fill in your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), California Secretary of State (SOS) file number, California corporation number, or Federal Employer Identification Number (FEIN) in the designated field.

- Part I requires information on sales of property used in a trade or business as well as involuntary conversions. Enter each property's description, date acquired, date sold, gross sales price, depreciation allowed or allowable since acquisition, and the cost or other basis plus improvements and expenses of sale.

- You will also need to calculate and enter gains from federal Form 4684, including any IRC Section 1231 gains.

- Continue to line 7 to combine your results from lines 2 through 6, recording the gain or loss as applicable.

- If applicable, report amounts related to IRC Section 179 assets and ensure to follow the instructions to determine the correct entries based on the form type (S Corporations, Partnerships, etc.).

- Proceed by inputting any nonrecaptured net IRC Section 1231 losses from prior years on line 8 to adjust subsequent calculations.

- In Part II, complete sections for ordinary gains and losses, entering each property's details as in Part I, adjusting for any individual tax return specifications.

- For Part III, summarize any gains relating to properties under IRC Sections 1245, 1250, 1252, 1254, and 1255, ensuring to complete corresponding calculations across the property columns.

- Lastly, if you recorded any recapture amounts, complete Part IV by entering expense deductions and calculating the recapture amount.

- Review all entries for accuracy, and when ready, you can save your changes, download the form, print, or share it as needed.

Start completing your CA FTB Schedule D-1 online today for an organized tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Schedule D is required when a taxpayer reports capital gains or losses from investments or the result of a business venture or partnership. The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.