Loading

Get Deferred Payment Agreement Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deferred Payment Agreement Template online

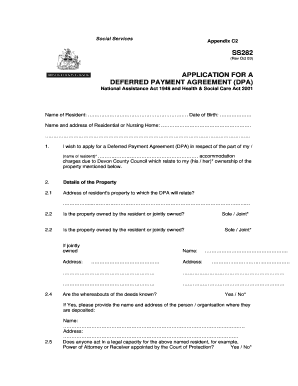

Filling out a Deferred Payment Agreement (DPA) is an essential step for individuals seeking financial support for their accommodation costs due to health care needs. This guide will provide you with a clear and structured overview of how to complete the DPA template online effectively.

Follow the steps to complete the Deferred Payment Agreement template successfully.

- Click 'Get Form' button to access the form and open it in your online editor.

- Begin by filling in the 'Name of Resident' field with the full name of the individual for whom the DPA is being submitted. Next, provide the 'Date of Birth' in the specified format.

- Input the 'Name and address of Residential or Nursing Home' where the resident is accommodated. Ensure that the address is complete and accurate.

- In section 1, clearly state your wish to apply for a DPA regarding the accommodation charges, referencing the name of the resident and the property ownership details.

- Proceed to section 2 to enter the 'Address of resident’s property' that the DPA relates to. If the property is jointly owned, you will need to specify that in the appropriate fields.

- Indicate whether the whereabouts of the property deeds are known. If yes, provide the name and address of the person or organization holding the deeds.

- If applicable, state if someone acts in a legal capacity for the resident. Provide their name, address, and relationship to the resident in the designated fields.

- Review and complete section 3, which outlines the terms of the agreement. Confirm your understanding of the charges and the legal implications involved with signing the DPA.

- Finalize the form by signing it and printing your name clearly. This step acknowledges that you have had the opportunity to seek independent legal and financial advice regarding the application.

- Once you have completed all sections of the form, ensure you save any changes, download a copy, or share the completed document as required.

Take the next step towards securing your Deferred Payment Agreement by completing the form online today.

Disadvantages of a Deferred Payment Agreement Your care costs aren't written off they're just delayed. The cost of your care will have to be repaid by you or your estate. As this is a loan, your agreed interest and charges are added to the cost of your care fees. Interest is usually applied on a compound basis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.