Loading

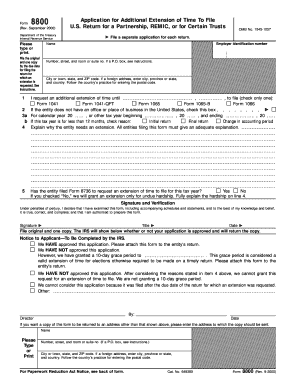

Get Form 8800

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8800 online

This guide provides clear and detailed instructions on how to complete Form 8800 online. Following these steps will help ensure that your application for an additional extension of time to file is accurately filled out and submitted on time.

Follow the steps to successfully complete and submit Form 8800 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your entity's name in the designated field. Ensure that you type or print legibly.

- Enter the employer identification number (EIN) in the corresponding section.

- Provide the full address of your entity, including the number, street, room or suite number, city, state, and ZIP code. If applicable, follow the format for a foreign address.

- Indicate the specific form for which the extension is being requested by checking only one box from the options provided.

- If your entity does not have a place of business in the United States, check the corresponding box.

- Complete the tax year fields: indicate the calendar year or other tax year, along with the start and end dates.

- If applicable, check the reason box for a tax year of less than 12 months, and provide detailed reasoning.

- In line 4, explain why your entity is requesting an extension. This explanation must be adequate to warrant the request.

- Answer whether the entity has previously filed Form 8736 for this tax year and indicate the choice made.

- Sign the form under penalties of perjury, including your title and the date signed.

- Finally, save changes to the form, and consider downloading, printing, or sharing the completed document as needed.

Complete your Form 8800 online to ensure timely filing and avoid penalties.

Use Form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). ... You'll need to refigure the amount on Form 1040 or 1040-SR, line 11, if you're filing Form 2555 or Form 4563 or you're excluding income from Puerto Rico. See Pub.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.