Loading

Get Sample Letter Of Disclaimer Of Inheritance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample Letter Of Disclaimer Of Inheritance online

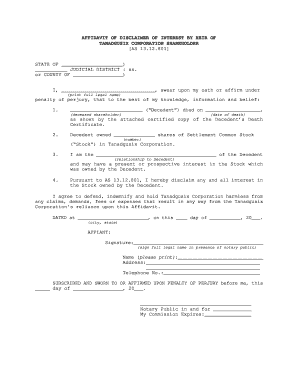

The Sample Letter Of Disclaimer Of Inheritance is a vital document for anyone looking to formally deny an inheritance. This guide provides clear, step-by-step instructions on how to complete this form online, ensuring that all necessary information is accurately included.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the full legal name of the person disclaiming the inheritance in the designated section. Ensure that your name is spelled correctly, as this will be critical for legal verification.

- Indicate the state and judicial district or county where the disclaimer is being filed. This information helps to establish the jurisdiction related to the decedent's estate.

- Fill in the details of the decedent, including their full name and date of death, which should correspond with the attached certified copy of the death certificate. This step verifies the relationship to the estate.

- Specify the number of shares in Tanadgusix Corporation that the decedent owned. This is important to clarify the extent of the interest being disclaimed.

- Describe your relationship to the decedent in the appropriate section to establish your connection and any potential claims to the stock.

- Read and agree to the statement that disclaims any interest in the stock owned by the decedent. This legally binds you to relinquishing your claims.

- Sign the document in the presence of a notary public to validate your acknowledgment and compliance. After signing, print your name and provide your contact details including your address and phone number.

- After all sections have been completed, proceed to save your changes, download the document, and print copies for your records. Additionally, retain a copy for submission to the designated authority.

Complete your documents online with confidence and ensure accuracy in your filings.

When you receive an inheritance, via a will, such as a house or cash, or as a beneficiary of an IRA or 401(k), or an estate, you can say thanks, but no thanks, and refuse it by disclaiming. The inheritance then passes to the next beneficiary, altogether bypassing the person who disclaims.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.