Get Ph Bir 1707 1999

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 1707 online

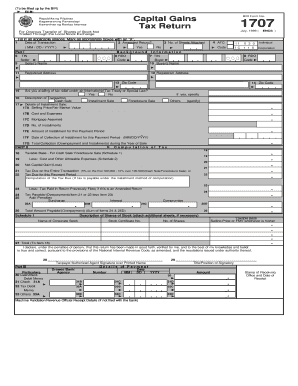

The PH BIR 1707 form is essential for reporting capital gains tax on the onerous transfer of shares that are not traded through the local stock exchange. This guide provides a clear, step-by-step approach to filling out the form online, making it accessible for all users, regardless of their prior legal knowledge.

Follow the steps to successfully complete the PH BIR 1707 form.

- Press the ‘Get Form’ button to access the PH BIR 1707 form in your preferred editor.

- Fill in the date of transaction in the MM/DD/YYYY format in the designated box labeled 'Date of Transaction'.

- Indicate whether this is an amended return by marking the appropriate box with an ‘X’.

- Provide the required number of sheets attached to your form in the 'No. of Sheets Attached' box.

- Enter the ATC code in the corresponding field to classify the type of transaction.

- Fill in your Tax Identification Number (TIN) and registered name in the 'Seller' section.

- Input the TIN and name of the buyer in the 'Buyer' section, along with their registered address and ZIP code.

- Select whether the transaction is a cash sale, installment sale, foreclosure sale, or other type by marking the appropriate box.

- If applicable, provide details of the installment sale, including selling price, cost and expenses, mortgage assumed, number of installments, and amounts.

- Transition to Part II to compute the tax. Enter the taxable base, allowable expenses, and calculate the net capital gain or loss.

- Calculate the tax due based on the net gain, specifying penalties, surcharges, and interest if required.

- Lastly, fill in your payment details and ensure to sign over your printed name, indicating your position or title.

- After completing the form, save your changes. You can then download, print, or share the completed form as necessary.

Complete your BIR documents online for a streamlined filing experience.

Get form

Filing an income tax return involves collecting all your income documents, completing the correct tax forms, and submitting them either online or at a designated BIR office. It is important to adhere to the instructions specific to PH BIR 1707 to avoid errors during filing. Simplifying this process is possible with platforms like UsLegalForms that streamline your tax submissions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.