Loading

Get Mn Dor Schedule M1mt 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1MT online

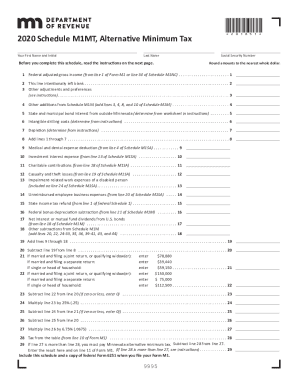

Filling out the MN DoR Schedule M1MT is essential for determining your Minnesota Alternative Minimum Tax obligations. This guide will provide you with clear, step-by-step instructions to help you complete this form accurately and efficiently online.

Follow the steps to fill out the MN DoR Schedule M1MT online

- Press the ‘Get Form’ button to obtain the MN DoR Schedule M1MT form and open it in the document editor.

- Begin by entering your first name, middle initial, and last name in the designated fields at the top of the form.

- Fill in your Social Security number in the appropriate section, ensuring that you input the correct numeric format.

- Refer to line 1 for your federal adjusted gross income obtained from line 1 of Form M1 or line 34 of Schedule M1NC, and enter that amount.

- For line 2, note that this line is intentionally left blank and should be skipped.

- On line 3, include any other adjustments and preferences. Consult the instructions to identify specific amounts required for this line.

- For lines 4 through 18, follow the instructions carefully to complete each section, adding up any relevant amounts from Schedule M1M where necessary.

- Line 19 requires you to sum the amounts entered in lines 9 through 18.

- Proceed to line 20 and subtract line 19 from line 8.

- For lines 21 and 22, enter the respective income thresholds based on your filing status as indicated on the form.

- On line 23, calculate the difference from line 22 and enter that number.

- Continue with lines 24 through 28 by following the previously provided calculations, making sure to apply the correct percentages and values.

- If required to pay Minnesota Alternative Minimum Tax, complete line 29 as indicated, subtracting line 28 from line 27.

- After filling out all sections, you can save your changes, download the completed form, print it, or share it as needed.

Complete your MN DoR Schedule M1MT online today to ensure you meet your tax obligations.

Related links form

The AMT is indexed yearly for inflation. For the 2022 tax year, it's $75,900 for individuals and $118,100 for married couples filing jointly. Higher income levels for exemption phaseout. Phaseout for the 2022 tax year starts at $539,900 for individuals and $1,079,800 for married couples filing jointly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.