Loading

Get Ks Form 219.1 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS Form 219.1 online

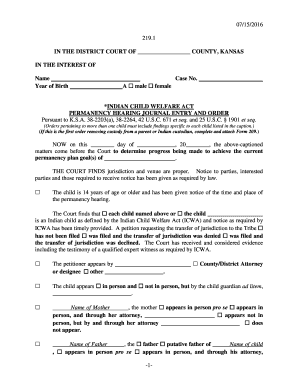

Filling out the KS Form 219.1 online is a crucial step in legal proceedings regarding child welfare. This guide will provide you with clear, step-by-step instructions to ensure you successfully complete the form with confidence.

Follow the steps to fill out the KS Form 219.1 accurately and efficiently.

- Select the ‘Get Form’ button to access and open the KS Form 219.1 in your preferred online format.

- Begin by entering the relevant details at the top of the form, including the name of the county and the case number. This information is essential for identifying the case.

- Indicate the current date and proceed to the findings section. Check off the applicable boxes regarding the child’s age, whether they are an Indian child under the Indian Child Welfare Act, and any petitions regarding jurisdiction.

- In the appearances section, provide the names and roles of individuals present during the hearing, including the child's guardian ad litem and the parents. Ensure that you check the appropriate boxes for their appearances.

- Move to the findings section that evaluates the efforts made by public or private agencies, as well as the child’s needs and progress towards permanency goals. Carefully check the relevant boxes based on the situation.

- Complete the final sections regarding orders made by the court, including next steps, placements, and any necessary future hearing dates. Ensure all fields are fully filled out.

- Once finished, review all entries for accuracy. After confirming everything is correct, you can save your changes, download the completed form, and print or share it as needed.

Complete your KS Form 219.1 online today for a streamlined process.

Related links form

Yes, a loss reported on a K-1 can reduce your taxable income, potentially reducing your overall tax liability. Understanding how these losses interact with your other income is crucial for effective tax planning. The KS Form 219.1 is an essential component in accurately reporting these figures. For more details and guidance, visit US Legal Forms for helpful resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.