Loading

Get Ny It-256 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-256 online

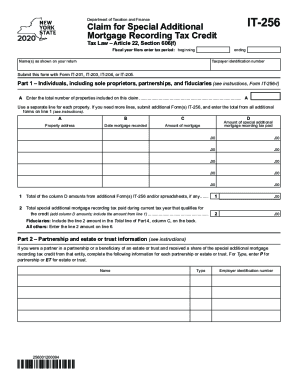

The NY IT-256 form is essential for claiming the special additional mortgage recording tax credit. This guide provides clear instructions to help you complete the form accurately and efficiently, ensuring you maximize your eligible credits.

Follow the steps to fill out the NY IT-256 form online.

- Press the ‘Get Form’ button to access the NY IT-256 form and open it in your preferred online editor.

- Begin by entering your name(s) as they appear on your tax return and your taxpayer identification number.

- In Part 1, record the total number of properties listed on your claim. Use a separate line for each property and submit additional IT-256 forms if necessary.

- Fill in the property address, date of mortgage recorded, and the amount of the mortgage for each property.

- In the column for the amount of special additional mortgage recording tax paid, enter the respective amounts for each property.

- Calculate the total of column D amounts and enter this total on line 1. Then, add these amounts together and report the total on line 2, depending on your status as a fiduciary or other.

- Complete Part 2 by providing the necessary information for any partnerships or estates or trusts you received credit from.

- In Part 3, enter your share of credits received from the partnership or estate or trust, providing relevant details.

- Input the corresponding amounts in Part 4 for beneficiaries to calculate the total share of credit.

- In Part 5, gather and enter the amounts from previous sections to determine the credit available for the current tax year.

- Proceed to Part 6, where you will compute the credit used and the options for carrying forward or refunding any unused credits.

- Once all fields are complete, you can save any changes made to the form, download, print, or share it as needed.

Start filling out your NY IT-256 form online today to ensure you receive your eligible tax credits.

Related links form

In NYC, the buyer pays a mortgage recording tax rate of 1.8% if the loan is less than $500,000 and 1.925% if more than $500,000 or more. Buyers of commercial property pay 2.55%. These rates are what the buyer is responsible for. Your mortgage lender will also contribute 0.25%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.