Loading

Get Ny It-112-r 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-112-R online

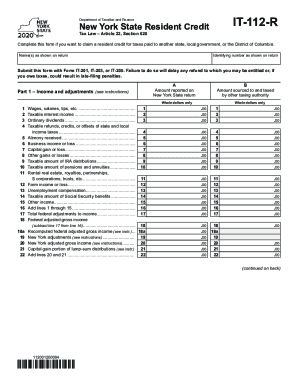

The NY IT-112-R form is essential for claiming a resident credit for taxes paid to other states, local governments, or the District of Columbia. This guide provides step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to successfully complete the NY IT-112-R online.

- Press the ‘Get Form’ button to access the NY IT-112-R form online.

- Begin by entering your name as it appears on your tax return in the designated area.

- Input your identifying number, also as shown on your tax return, in the corresponding field.

- In Part 1, enter your income and adjustments as reported on your New York State return. Fill in the amounts for wages, salaries, interest income, and other specified income sources.

- Calculate your total federal adjustments to income and enter this figure in line 17.

- Derive your federal adjusted gross income by subtracting line 17 from line 16 and input this on line 18.

- Proceed to New York adjustments in line 19 and determine your New York adjusted gross income, entering it on line 20.

- In Part 2, list the two-letter abbreviation of the state or locality where tax was paid on line 23, also providing the locality name if applicable.

- Enter the amount of income tax that was charged for that other state or locality's return on line 24.

- Calculate the New York State tax payable and enter it on line 25.

- Complete the calculations in lines 26 to 30 to determine the total resident credit due.

- In Part 3, provide any applicable tax due amounts and credits before your resident credit as indicated in the instructions.

- In Part 4, enter the tax withheld and estimated tax payments made to the other state or locality in line 35.

- Finalize your entries by checking that all sections are filled in accurately.

- Once all fields are completed, save your changes, download a copy, or print the completed form for your records.

Complete your NY IT-112-R form online today for a smoother tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

New York State resident credit (This income generally includes wages and business income. It typically excludes interest, dividends, gambling winnings, and lottery winnings.) you were a shareholder of an S corporation and you pay the tax calculated on the S corporation income.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.