Loading

Get Dc Schedule H 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC Schedule H online

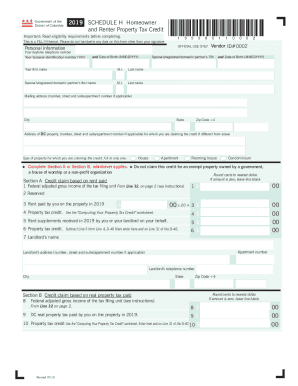

Filling out the DC Schedule H is an important step for individuals seeking homeowner and renter property tax credits in the District of Columbia. This guide provides detailed instructions to help users navigate the online form efficiently.

Follow the steps to successfully complete your DC Schedule H online.

- Click ‘Get Form’ button to access the DC Schedule H and open it in the online editing tool.

- Begin by entering your personal information in the designated fields. This includes your first name, middle initial, last name, taxpayer identification number (TIN), date of birth, and daytime telephone number.

- Proceed to input your mailing address, ensuring accuracy in the street name, apartment number (if applicable), city, state, and zip code.

- Specify the address of the DC property for which you are claiming the credit if it differs from your mailing address.

- Identify the type of property you are claiming the credit for by selecting one option from the available choices, such as 'house of worship' or 'apartment.'

- Complete either Section A or Section B based on your situation. Section A is for credit claims based on rent paid, while Section B pertains to claims based on real property tax paid.

- In Section A, provide your federal adjusted gross income and the total rent paid in 2019, and follow up with calculations for the property tax credit using the provided worksheet.

- If applicable, detail any rent supplements received in 2019 to calculate your final property tax credit in Section A.

- In Section B, enter your federal adjusted gross income from the relevant line and the total DC real property tax paid in 2019 to determine your property tax credit.

- Fill out the refund options section, specifying whether you prefer direct deposit or a paper check for any refund owed.

- Sign the form, ensuring that all parties required, such as your spouse or partner, also sign if submitting jointly.

- Review the completed form for any errors, and then save your changes, download a copy, print it, or share it as needed.

Complete your DC Schedule H online today to ensure you receive the property tax credits you may qualify for.

Related links form

The Individual Income Tax Credit reduces the DC individual income tax liability of eligible homeowners and renters by up to $750. If your household's total income is $20,000 or less, you may be eligible. To apply, file a Schedule H (Property Tax Credit Form) with your Form D-40 (Individual Income Tax Return).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.