Loading

Get Ca Form 3803 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 3803 online

This guide provides a comprehensive overview to help you fill out the CA Form 3803 online. Designed for ease of use, it walks you through each step and field required for successful completion and submission.

Follow the steps to complete the CA Form 3803 effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your chosen editor.

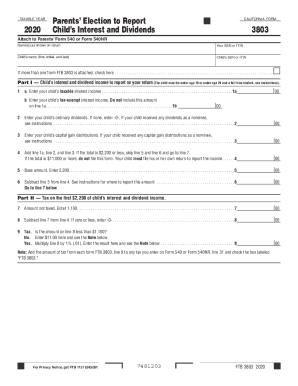

- Begin by entering the taxable year in the designated field at the top of the form, specifying '2020'.

- Input the names and social security numbers (SSN) or Individual Taxpayer Identification Numbers (ITIN) of the parents as shown on their return.

- Fill in the child’s name, including the first name, initial, and last name.

- Enter the child's SSN or ITIN in the specified area.

- If you have multiple forms attached, check the box to indicate so.

- In Part I, report the child’s interest and dividend income. Start with line 1a by entering the taxable interest income.

- Move to line 1b and provide the child’s tax-exempt interest income, ensuring not to include this on line 1a.

- On line 2, enter the child’s ordinary dividends. If none, write -0-.

- For line 3, report any capital gain distributions received by the child.

- Add together the amounts from lines 1a, 2, and 3 on line 4. If this total is $2,200 or less, proceed to line 7. If it is $11,000 or more, the child must file their own tax return.

- For line 5, simply enter '2,200' as the base amount.

- Subtract line 5 from line 4 on line 6. This amount is crucial for the next calculation.

- In Part II, on line 7, enter '1,100' as the amount not taxed.

- For line 8, subtract line 7 from line 4. If the result is zero or negative, enter -0-.

- Determine the tax on line 9 based on the amount in line 8 and follow the specific instructions provided in the notes section.

- Once all information is completed and verified, save the changes to the form. You may then download, print, or share the completed form as needed.

Complete your CA Form 3803 online today for a seamless filing experience.

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.