Loading

Get Ie Tr2 (ft)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE TR2 (FT) online

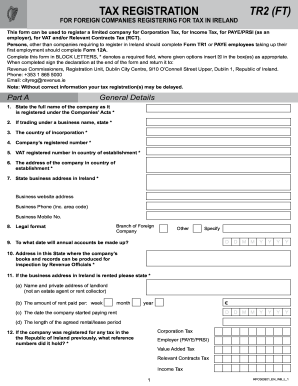

This guide provides comprehensive instructions on filling out the IE TR2 (FT) form online for foreign companies registering for tax in Ireland. Follow these steps to ensure a complete and accurate submission, facilitating a smooth registration process.

Follow the steps to complete the form seamlessly:

- Press the 'Get Form' button to access the IE TR2 (FT) document and open it in the designated online editor.

- Begin with Part A, General Details. Fill in the full name of the company as registered under the Companies’ Acts in the first required field. If the company is trading under a business name, provide that name as well.

- Provide the country of incorporation and the company's registered number in the following fields, as these are also required.

- Enter the VAT registered number in the country of establishment and the company’s address in the country of establishment. Next, specify the business address in Ireland.

- Continue by providing additional contact information, including the business website address, business phone number (including area code), and business mobile number.

- Indicate the legal format of the business, specifying whether it is a branch of a foreign company or another format.

- State the anticipated date for annual accounts. Respond to the required address section where the company’s books and records will be available for inspection.

- If the business address in Ireland is rented, detail the landlord’s name and private address, the amount of rent, commencement date, and the agreed rental period.

- Proceed to complete the Corporation Tax section. If the company has previously registered for any tax in Ireland, provide the reference numbers for each tax category.

- Fill in the type of business, including whether it is mainly retail, wholesale, manufacturing, etc. Describe the business operations in as much detail as possible.

- Provide the information of directors, company secretary, shareholders with 30% or more interest, and details of an adviser, if relevant.

- Continue to Part B to register for Corporation Tax, Income Tax, and provide additional relevant details such as the date the company commenced trading.

- In Part C, register for VAT by indicating the registration date and whether the company needs to elect for taxable status.

- Proceed to Part D to register as an employer for PAYE/PRSI, indicating if you will engage employees and providing relevant employment start dates.

- Complete Part E for registration under Relevant Contracts Tax (RCT), stating if the application is for a principal contractor, subcontractor, or both.

- Finally, review all entries and sign the declaration in BLOCK LETTERS, confirming the accuracy of the information provided. Save your changes, download, or print the completed form.

Complete your IE TR2 (FT) registration online for a seamless tax process.

Related links form

Deciding whether to claim 0 or 1 exemptions often depends on your personal financial situation. Claiming 0 typically results in higher withholding, which can benefit those who expect to owe taxes at year's end. Conversely, claiming 1 may provide smaller withholding but can lead to a larger refund. Assess your situation thoroughly, and consider using the IE TR2 (FT) form to guide your decision.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.