Loading

Get Charitable Valuation Guide - Salvation Army

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Charitable Valuation Guide - Salvation Army online

The Charitable Valuation Guide provided by the Salvation Army is an essential resource for individuals looking to donate items and receive appropriate valuations for tax purposes. This guide will help you navigate the process of filling out this form online efficiently and accurately.

Follow the steps to complete the Charitable Valuation Guide online.

- Click the ‘Get Form’ button to access the Charitable Valuation Guide and open it in a suitable editor.

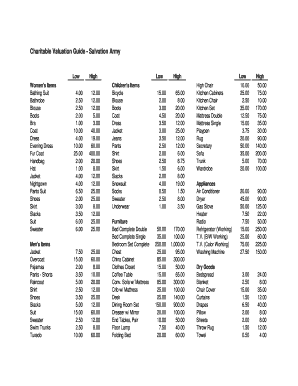

- Review the items listed in the guide, which are categorized into women's items, men's items, children's items, appliances, and dry goods. Familiarize yourself with the valuation range provided.

- Enter the items you plan to donate in the appropriate sections of the form, ensuring that you match them to the valuation ranges listed.

- For each item, indicate the condition (such as new, gently used, or worn) as this may affect the valuation.

- After completing the list of items and their respective valuations, review the information for accuracy.

- Once you have finalized all entries, save your changes. You may also have the option to download, print, or share the completed form as needed.

Start filling out the Charitable Valuation Guide online today to streamline your donation process.

The Salvation Army does not set a valuation on your donation. It's up to you to assign a value to your item. For professional advice, please consult your tax advisor. PLEASE NOTE: This list is not all-inclusive, and not all items are accepted at every location.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.