Loading

Get Canada Reg3062 2006-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada REG3062 online

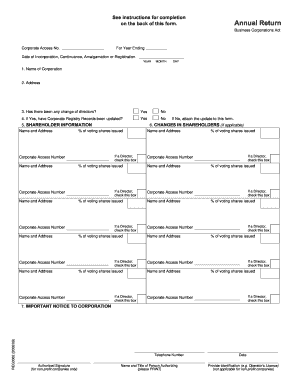

Filling out the Canada REG3062 is an essential task for corporations in Canada, ensuring compliance with the Business Corporations Act. This guide provides clear instructions on how to complete this form online, making the process straightforward and accessible for all users.

Follow the steps to accurately complete your Canada REG3062 form.

- Click ‘Get Form’ button to obtain the REG3062 and open it for editing.

- Enter the name of the corporation in the designated field. Ensure that this is the official name registered with the corporate registry.

- Provide the address of the corporation. This should be the registered office address or an address for service by mail.

- Indicate whether there has been any change of directors. Select 'Yes' or 'No' as applicable.

- If you answered 'Yes' to the previous question, confirm whether the corporate registry records have been updated by selecting 'Yes' or 'No'.

- In the shareholder information section, list each shareholder's name, address, and percentage of voting shares issued. If a shareholder is also a director, check the corresponding box.

- For changes in shareholders, provide the necessary details in the designated section, ensuring you also check if they are directors.

- Fill in the telephone number and provide the authorized signature if applicable, including the name and title of the person authorizing the form.

- Check any additional requirements or attachments needed based on the type of corporation, particularly if it is a non-profit organization.

- Once all fields are completed, review the information for accuracy. You may then save changes, download, print, or share the form as needed.

Complete your Canada REG3062 online today for a seamless filing experience.

Related links form

The annual income of a Canadian varies widely based on occupation, location, and experience. On average, full-time workers earn a significant income, which affects their tax obligations. Understanding your income bracket is essential for proper tax planning. You may find resources on uslegalforms helpful for managing your compliance with Canada REG3062.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.