Loading

Get Loan Modification Package Checklist

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Modification Package Checklist online

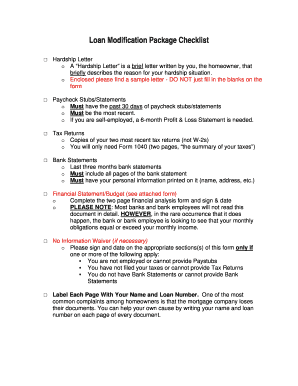

The Loan Modification Package Checklist is an essential document for homeowners seeking to modify their mortgage. This guide provides step-by-step instructions on how to efficiently fill out the checklist online, ensuring that you understand each component and its significance.

Follow the steps to complete the Loan Modification Package Checklist online.

- Press the ‘Get Form’ button to access the Loan Modification Package Checklist. This will open the form in your chosen online editor.

- Begin by drafting your hardship letter. This letter should summarize the reason for your financial challenges. Review the enclosed sample letter for guidance, but be sure to write your own unique explanation.

- Gather your paycheck stubs or statements for the past 30 days. Ensure these documents are the most recent. If you are self-employed, prepare a 6-month profit and loss statement instead.

- Collect copies of your two most recent tax returns, specifically Form 1040, which provides a summary of your taxes.

- Prepare your last three months of bank statements. Ensure that these statements include all pages and display your personal information, such as your name and address.

- Fill out the financial statement/budget form provided. Complete the two-page financial analysis and sign and date the document. Note that while most banks do not read this document in detail, it is important to ensure that your monthly obligations are aligned with your income.

- If applicable, sign and date the no information waiver if you cannot provide paycheck stubs, tax returns, or bank statements.

- Label each page of your documents with your name and loan number to prevent any issues with lost paperwork.

- Carefully review all filled sections for accuracy. Once completed, you can choose to save changes, download, print, or share the form as necessary.

Complete your Loan Modification Package Checklist online today to take the first step towards mortgage modification.

There are about 35 40 pages in a loan modification package.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.