Loading

Get Illinois Estate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois Estate online

Filling out the Illinois Estate form can seem daunting, but with clear instructions, it becomes manageable. This guide provides a step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to effectively complete the Illinois Estate form online.

- Press the ‘Get Form’ button to obtain the Illinois Estate form and open it for editing.

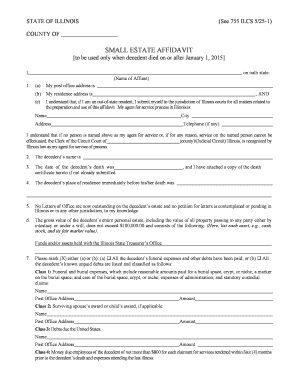

- Begin filling out Section 1 with your information. Enter your name as the affiant, and provide your post office address and residence address. If you are an out-of-state resident, include your agent for service of process in Illinois.

- In Section 2, write the decedent’s name and date of death. Ensure you attach a copy of the death certificate if not already submitted.

- Section 4 requires you to enter the place of residence of the decedent immediately before death.

- Confirm in Section 5 that no Letters of Office are outstanding on the decedent’s estate and note if any petitions are pending.

- In Section 6, state that the gross value of the decedent’s personal estate does not exceed $100,000. List each asset along with its fair market value.

- In Section 7, indicate whether all funeral expenses and debts have been paid or list the known unpaid debts, categorizing them as needed.

- Complete Section 9 by listing the names and residences of the surviving spouse and any minor or adult dependent children.

- Decide whether to mark Section 10a (no will) or 10b (a will exists), providing the relevant details for heirs or legatees.

- In Section 11, specify how the remaining property should be distributed after all debts are paid. Include specific sums or properties.

- After completing all sections, sign the affidavit, providing your daytime telephone number and the date. Have a notary public sign and date the affidavit as well.

- Lastly, you may save changes, download, print, or share your completed form.

Start filling out your Illinois Estate documentation online today to ensure a smooth and compliant process.

Generally, there will be an estate tax exemption, where estates under a certain set amount will not be subject to a tax. As of 2021, at the federal level the exemption is set at 11.7 million dollars. Any value beyond that number is taxed at a rate of 40 percent. In Illinois, the exemption level is 4 million dollars.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.