Loading

Get Ky Form 2210-k 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Form 2210-K online

Filling out the KY Form 2210-K online can be straightforward if you understand each component. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the KY Form 2210-K online effectively.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

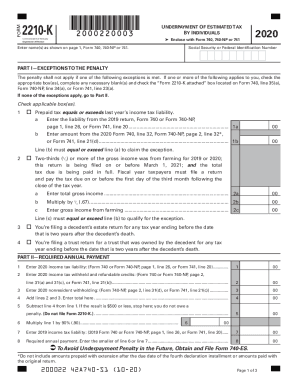

- Locate the section to enter your name as it appears on Forms 740, 740-NP, or 741, as well as your Social Security or federal identification number.

- In Part I, review the exceptions to the penalty. If applicable, check the relevant box or boxes and provide additional information as required for the identified exceptions.

- Move to Part II and enter your 2020 income tax liability from the appropriate line of Form 740 or Form 740-NP, or Form 741.

- Record the total amount of tax withheld and refundable credits from the respective lines of the applicable forms.

- Input the amount of nonresident withholding, if any, from the correct lines on the forms mentioned.

- Add the amounts from lines 2 and 3, and enter the total in line 4 of Part II.

- Calculate the difference between your total income tax liability and the total tax withheld. If the result is $500 or less, you may not owe a penalty and do not need to file this form.

- Proceed to calculate the required annual payment by determining the smaller amount between 90% of your current year's liability or the previous year’s income tax liability.

- Complete the payment due dates section by entering the required installment amounts for each specified date.

- If applicable, calculate your estimated tax penalty using the provided formula and enter this amount on the designated line.

- Double-check all entries for accuracy. Once completed, you can save changes, download, print, or share the form as needed.

Complete your KY Form 2210-K online today for a smoother tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

1. Late Filing Penalty: The penalty is 2% of the total taxes owed for every 30 days or fraction of that time that a return is filed after the tax return deadline. The maximum penalty is 20% of the taxes owed amount.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.