Loading

Get Ar Form Ar1000td 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR Form AR1000TD online

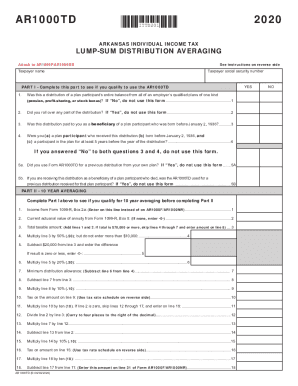

Filling out the AR Form AR1000TD online can simplify your tax filing process, especially if you are qualifying for lump-sum distribution averaging. This guide provides a clear, step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the AR Form AR1000TD online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide your taxpayer name and social security number as required.

- Complete Part I by answering the qualifying questions to see if you can use the AR1000TD. Answer each question accurately, and note that if you answer 'No' to key questions, you may not be eligible to use this form.

- If eligible, move to Part II and fill in the required income data starting with the income from Form 1099-R, Box 2a.

- Provide the current actuarial value of the annuity from Form 1099-R, Box 8, or enter -0- if none.

- Calculate the total taxable amount by adding the values from lines 1 and 2. If this total is $70,000 or more, skip the following calculation lines.

- Follow through the computation lines for minimum distribution allowance and taxes as outlined on the form.

- Ensure all calculations reflect the taxable amount accurately and are entered into the correct lines as directed.

- Once completed, review all entries for accuracy before you save the form.

- Finally, save your changes, download, print, or share the completed form as needed.

Complete your AR Form AR1000TD online today to streamline your tax filing process.

Form AR-TX is a form you should receive from your employer. Use the information on the form to complete the Texarkana portion of the Arkansas interview. Go into your Arkansas return and continue to the Border City Exemption page.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.