Loading

Get Usda Fsa-426-a 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USDA FSA-426-A online

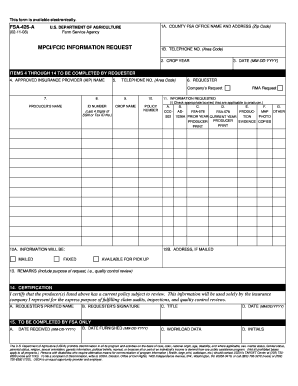

The USDA FSA-426-A form is a crucial document for requesting specific insurance information related to crops. This guide provides clear, step-by-step instructions to help users complete the form accurately online.

Follow the steps to successfully complete your USDA FSA-426-A form.

- Press the ‘Get Form’ button to access the form and open it for editing.

- In section 1A, enter the name and address of your county FSA office, including the Zip Code.

- Provide a contact telephone number in section 1B, ensuring to include the area code.

- Indicate the relevant crop year in section 2.

- Enter the current date in the format MM-DD-YYYY in section 3.

- For items 4 through 14, complete the necessary information as the requester. Start with entering the name of the approved insurance provider in section 4.

- Input the telephone number for the insurance provider in section 5, including the area code.

- Specify the type of request in section 6, choosing whether it is a company request.

- In section 10, fill out the producer’s name, followed by their identification number, which should be the last four digits of their Social Security Number or Tax ID number.

- Next, provide the crop name in section 11, and include the policy number in the designated field.

- In section 12A, indicate how information will be received by checking the appropriate box (mailed, faxed, or available for pick up).

- If you chose 'mailed' in section 12A, provide the mailing address in section 12B.

- Use section 13 for any additional remarks, such as the purpose of your request.

- In section 14, certify the information by entering the requester’s printed name in part A, followed by the signature in part B, and include the title and date.

- Finally, ensure that all details are correct before saving your changes, downloading, printing, or sharing the completed form.

Begin filling out your USDA FSA-426-A form online today for a smooth application process.

Yes, participating in a USDA survey can help the agency gather important data to better serve farmers and provide essential programs. While it may seem like an added task, your input can contribute to improvements in agricultural policies and support initiatives like those tied to USDA FSA-426-A. Your engagement makes a difference for the farming community.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.