Loading

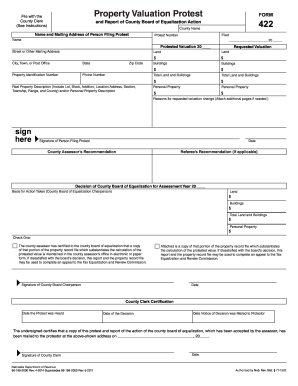

Get Nebraska Form 422

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Form 422 online

Filling out the Nebraska Form 422 is essential for individuals wishing to protest property valuations. This guide will provide you with clear, step-by-step instructions on completing the form online, ensuring that you understand its components and can effectively navigate the process.

Follow the steps to accurately complete your Nebraska Form 422 online.

- Click the ‘Get Form’ button to access the Nebraska Form 422 and open it in the online editor.

- In the 'County Name' field, enter the name of the county where the property is located.

- Fill in the 'Name and Mailing Address of Person Filing Protest' section with your full name and address. Ensure this information is accurate and up to date.

- Provide the 'Protest Number' if applicable. You may leave this blank if you do not have a protest number.

- In the 'Protested Valuation' section, enter the valuation amount that you are protesting for the year indicated.

- Complete the 'Requested Valuation' fields for both Land and Buildings. State clearly the amounts you are requesting for each category.

- Include your 'Phone Number' for any follow-up communications regarding your protest.

- In the 'Real Property Description' section, provide a detailed description of the property, including lot, block, addition, and address.

- In the 'Reasons for requested valuation change' area, outline the rationale behind your protest. If necessary, attach additional pages.

- Sign in the designated area to confirm your protest and include the date of signature.

- After completing all fields, review your information for accuracy. Once confirmed, save your changes, download the completed form, or print it directly.

Take the next step by completing your Nebraska Form 422 online today.

You can dispute your property tax on your own without an attorney or realtor, though professional guidance can help. Even if you bought your home this year, your property taxes may not necessarily be valued at the recent purchase price.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.